How can companies use personnel cost controlling to reliably plan, measure and manage workforce costs despite inflation and a shortage of skilled workers?

Why is personnel cost controlling so important?

In Germany, Austria, Switzerland and many other European countries, the cost of wages and salaries in companies is by far the largest cost item. This applies in particular to the service sector. This calls for a functioning personnel cost controlling system in which the planning, control and management of costs must be the main tasks. In the end, the important questions are: In which departments can I afford how many additional employees as a company, or is there even a budget for this? What wage cost increases are realistic and affordable? Collective wage agreements also have a massive impact on personnel cost controlling, so that these must always be calculated in detail in order to continue to operate economically in the following year. Personnel cost controlling is the area of human resources controlling that deals exclusively with the planning, measurement and control of relevant financial key figures – personnel costs.

1. Know the central parameters and key figures for personnel cost controlling

Three central parameters are of importance in personnel cost controlling:

- Headcount

- Full Time Equivalent (FTE)

- Workforce costs

Headcount

Headcount or “heads” is the number of employees in total or as the sum of employees in individual cost centers, branches or national companies. For personnel cost controlling, the key figure plays a role in personnel cost planning when employees are hired or fired. The “headcount” parameter can also be used in scenario comparisons or change analyses to quickly identify the areas in which personnel need to be increased or reduced.

Full Time Equivalent (FTE)

In many companies, the proportion of part-time employees is now 30-40% and rising.

In order to establish comparability of workforce costs and benefits, all part-time employees must be converted to full-time equivalents, because otherwise apples would be compared with oranges. Employees who work part-time are not comparable in terms of workload and costs to full-time employees who perform exactly the same job.

For this reason, full-time employees are set as a reference value of 1 FTE, and the employment level of part-time employees is set as a proportional FTE. For the calculation of FTE in total, the percentages of part-time employees are added together.

Particularly due to the increasing development in the part-time sector, personnel cost controlling becomes more comprehensible and controllable with the FTE key figure.

Workforce costs

Workforce costs are at the heart of personnel cost controlling, because their planning largely determines the success of a company’s economic development in the medium and long term.

In addition to fixed cost components such as monthly salary, social security contributions and payroll taxes, workforce costs also include variable components such as bonuses, Christmas bonuses and vacation pay.

The workforce costs for employees covered by collective bargaining agreements are derived from corresponding pay scales.

Since the calculation is complex and also changes on a monthly basis, it makes sense to always have the ACTUAL workforce costs from the relevant payroll systems available for calculating the planned costs. This makes it very easy to create forecasts, PLAN costs and other scenarios.

2. Plan and extrapolate personnel measures precisely

Accuracy of key figures through employee-centric planning

In order to be able to carry out personnel cost controlling accurately, and to provide reliable data, accuracy is required first and foremost. It is, of course, possible to carry out blanket personnel planning if you do not even know what costs additional employees will cause. In most cases, however, reference values do exist. That is, there are already employees who hold a similar position from which projected costs can be derived. In general, only employee-specific planning can be the basis for calculating dependent variables such as SI contributions, taxes and bonuses. Granularity does not provide blanket planning.

When does lump-sum action planning make sense?

In uncertain times, companies are often confronted with making decisions for which no figures are yet available. While a reference value is available for the departure of employees, entire departments or the change in the employment level, this is not always possible for the planned addition of individual persons or teams. Especially when inflation fluctuates strongly or the skills are not yet available in the company, it can make sense to work with a blanket action plan. In that case, you would fill the vacancies with a comparative value that is not 100% accurate, but an estimate.

Accurate personnel cost controlling through integrated systems

In general, for all key figures on headcount, FTE and costs, the historical values are already available in the payroll system. So there is a lot to be said for using the ACTUAL data and basing personnel cost planning on it, since you only have to define the deviation from the ACTUAL values in planning. Via interfaces to various HR systems, it is now possible to use the real-time data as a planning basis for employees. Such interfaces are available for HR systems such as SAP HCM, SAP SuccessFactors, Personio, Workday, DATEV and many more. But even if such interfaces are not available, it is usually possible to perform personnel cost controlling on a regular basis using Excel imports.

In terms of saving time, it is recommended that every HR planner work with ACTUAL data from integrated HR systems.

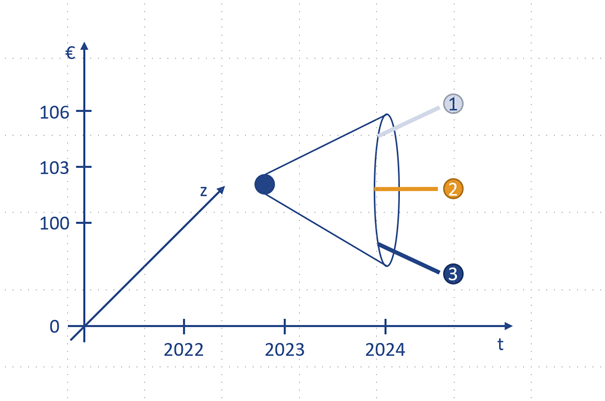

3. Test different assumptions with scenario comparisons

How do scenario comparisons help in personnel cost controlling?

Scenario comparisons are a useful tool for looking at and comparing different projected development possibilities. However, it is important to note that as humans we often think linearly and feel overwhelmed with more than 4 variables. It is therefore important to ensure comparability in our decisions and predictions.

We should be aware that our decisions are rarely fully rational and are often influenced by emotions and personal experiences. One way of improving our decision-making is to examine different scenarios and compare them in personnel cost controlling in terms of headcount, FTE and costs.

What should be considered when setting up scenarios?

When comparing scenarios in HR controlling, it is primarily important to make the most likely assumptions and options in advance in order to identify possible worst- and best-case scenarios afterwards.

For example, due to high inflation, cost increases of 5% or more likely 10% can currently be assumed, which could be distributed evenly among all employees. Alternatively, the assumption can be made that in departments where there is a shortage of skilled workers, the cost increase must be higher in order to retain employees there. However, the cost increases may well be lower and only apply to new hires.

In addition to cost increases, scenarios in the area of staff expansion and reduction naturally play a major role. What are the costs of planned new hires at a particular location? And what cost savings result if a reduction in personnel is a possible scenario in individual cost centers?

These questions can be answered and compared very clearly with the reporting of personnel cost planning. The decision as to which paths lead to the goal is often already predetermined by budget specifications. How this goal is achieved, however, is determined by personnel cost controlling on the basis of scenario comparisons with simultaneous comparison of the existing budget from financial controlling.

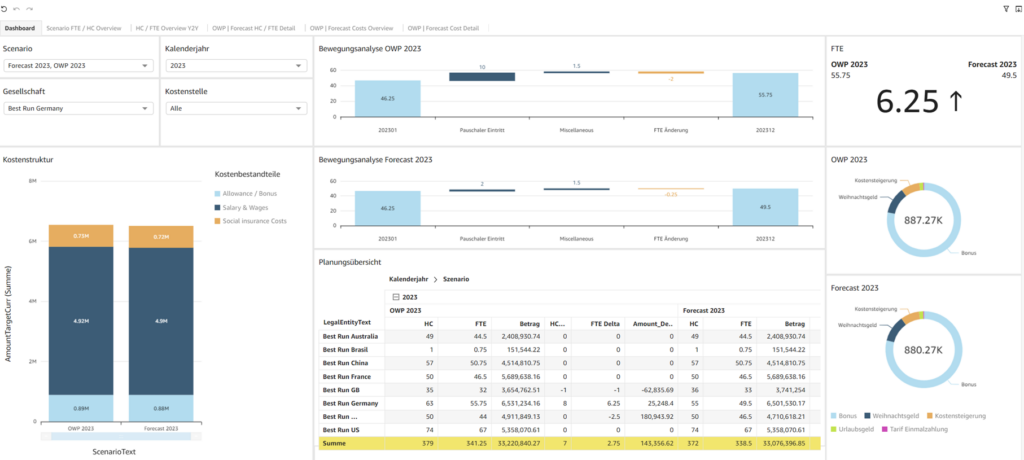

4. Effectively use reporting and scenario comparisons in personnel cost controlling

Relate planned workforce costs to each other

In personnel cost planning reporting, it should be possible to see at a glance how two or more scenarios relate to each other. A clear presentation shows the personnel costs incurred in scenario 1 and those incurred in scenario 2 and the individual measures that caused the difference. The change analysis in terms of headcount and FTE can also be seen centrally at a glance. Bar charts are recommended for the presentation, as this cannot always be quickly captured from Excel lists.

Which key figures should an HR controlling dashboard contain?

In personnel cost controlling, headcount, FTE and personnel costs are the decisive influencing variables. A valuable analysis method for this is the headcount bridge, which describes the gap between a company’s current headcount and the headcount needed to achieve its goals. It also presents planned changes in headcount (e.g., hiring, layoffs, or restructuring). It is recommended to work with a self-service reporting tool, in which employees of personnel controlling or financial controlling can compile their own reports at any time as desired.

5. Intra-year forecasting with rolling personnel cost planning

Advantages of rolling workforce planning

Rolling workforce planning is a method of personnel cost planning in which the planning horizon is continuously updated and actual data is incorporated into the planning. By regularly updating the planning horizon with current data, greater planning accuracy is achieved.

The addition of previously planned measures eliminates the need for manual re-entry. This means that the plan can be continuously updated to reflect changes and unforeseen events without requiring significant manual effort.

This method offers the best conditions for forecasting, as updating the planning horizons based on current data helps to make more accurate predictions for the future.

In addition, rolling workforce planning enables a faster response through prompt plan/actual comparison. By continuously comparing the actual data with the plan, the company can react quickly to deviations and take measures to adjust the planning.

Frequency of rolling workforce planning

Rolling workforce planning is the ongoing update of personnel cost planning within the current fiscal year. Unlike annual planning, which is done at the beginning of the year and then applies to the entire year, in-year planning allows adjustments to be made to the plan to reflect ongoing business needs and changes in staffing requirements.

Intra-year workforce planning typically involves periodic review of personnel cost budgets to ensure they are in line with actual results. If necessary, adjustments can be made to the planning to compensate for deviations between actual results and expected results.

The frequency is distributed differently in the companies, the following frequencies are common:

- Monthly personnel cost planning

- Quarterly personnel cost planning

- Occasion-related personnel cost planning

- Introduction of new products

- Growth of the company

- Restructuring, mergers and acquisitions

- Statutory or collective bargaining changes

How often a company performs personnel cost planning depends on its internal processes. The more flexible the planning system and the more up-to-date the underlying data, the more realistic the personnel cost planning. Personnel cost controlling at the intervals defined above is also responsible for making adjustments to planning as required, e.g. if budgets are exceeded or not met.

Are you interested in integrated personnel cost controlling for your company?

Now free consultation appointment request

More information on personnel cost planning and personnel cost controlling:

References and success stories for integrated personnel cost controlling

We would be pleased to convince you of our solutions and our competence – we would also be pleased to put you in contact with our reference customers.